By Steve Toloken

STAFF REPORTER / ASIA BUREAU CHIEF

Published: October 30, 2014 12:21 pm ET

Updated: October 30, 2014 12:26 pm ET

Image By: Rich Williams

Image By: Caroline Seidel

Asia Bureau Chief Steve Toloken.

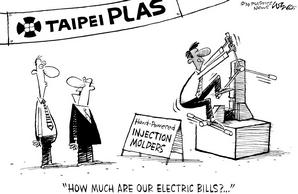

A trip to a show like Taipei Plas in Taiwan is a nice reminder that there’s a whole world in the plastics industry outside the top technology shown at mega-events in “mature” economies, like Germany’s K Fair, NPE in the United States and IPF show in Japan.

Taiwan itself is a pretty “mature” economy, but its national show, held Sept. 26-30, attracts a lot of buyers from the emerging markets in plastics.

Companies from Jordan and Iraq mingled alongside buyers from Bulgaria, the United Arab Emirates and India.

Taiwanese firms, which seemingly are the consummate traders and will travel anywhere, are also doing a lot more sales of plastics equipment to Africa — exports to Nigeria, South Africa, Algeria and Kenya were up substantially this year, albeit from small bases.

I remember on another visit to Taiwan, a local plastics equipment salesman was telling me about his business trip to North Korea to peddle blow molding machines.

He said they took his passport when he arrived and he didn’t get it back until he left. (That’s one way to get some leverage in the negotiations!)

I didn’t meet any North Koreans at the show, but about 60 percent of the international attendees of the Taiwan show come from emerging markets.

You can see that same range of buyers at the Chinaplas show as well. The plastics industry is growing in a lot of places, in ways that may not be so obvious at K or NPE.

Some of the big Western firms are moving in that emerging direction — I think the decision by Austria’s Engel Holding GmbH to set up its Wintec subsidiary in China this year, where they make simpler machines designed for Asian manufacturers of commodity products, can be read as acknowledging it needed a new offering to better tap that potential.

And it’s the same trend that’s fueled a lot of growth for Chinese press maker Haitian International Holdings, as it’s ramped up in the last decade to be one of the largest machine makers in the industry.

Taiwanese firms see themselves as tapping into those same value markets, but differentiating themselves on service and solutions.

Manufacturers there are among the best in the world at making things. Companies like Foxconn and Pegatron (which is reportedly making half of the 50 million iPhone 6 phones for Apple) have strong positions in the electronics manufacturing services industry.

Foxconn, in a move that attracted a lot of attention on the floor of Taipei’s Nangang exhibition center, unveiled its own all-electric injection molding machines, for the first time at an exhibition.

It’s an unusual move: a company that’s a huge user of molding machines (10,000 presses in its factories around the world) wants to get into the business of making the molding machines.

So Taiwan is not necessarily a low-tech market, as becomes apparent when you ride the bullet trains up and down the island. It also seems to be attracting more buyers — attendance this year was up 17 percent, to 18,600.

Its machinery industry is squeezed between the top technology in the West and Japan, and the up and comers in mainland China.

At a show like Taipei Plas, you do meet all kinds of companies. For example, I met an executive with an Indian firm making hand-powered injection and blow molding machines. That’s right: hand-powered, with a wheel the operator turns. I’d enjoy seeing those in operation.

If that doesn’t remind you there’s a lot more to this industry than high-tech offerings at K, nothing will.

Toloken, Plastics News’ Asia bureau chief, lived in China and Hong Kong from 2006 to 2014.

|